Contents:

To calculate accumulated depreciation, you’ll need to add all the depreciation amounts for each year to date. Accumulated depreciation is the total amount of depreciation of a company’s assets, while depreciation expense is the amount that has been depreciated for a single period. Depreciation is an accounting entry that represents the reduction of an asset’s cost over its useful life. The double declining balance depreciation method is an accounting approach that involves depreciating some assets at twice the rate specified by straight-line depreciation. Total accumulated depreciation at the end of the period is not generally reported in the face of financial statements.

How to Record a Depreciation Journal Entry: Step By Step – The Motley Fool

How to Record a Depreciation Journal Entry: Step By Step.

Posted: Fri, 05 Aug 2022 07:00:00 GMT [source]

Alternatively, the accumulated expense can also be calculated by taking the sum of all historical depreciation expense incurred to date, assuming the depreciation schedule is readily available. Per the matching principle, the expenditure must be spread across the useful life of the fixed asset, i.e. the number of years in which the fixed asset is expected to provide benefits. Depreciation is an accounting method of allocating the cost of a tangible asset over its useful life to account for declines in value over time. The balance rolls year-over-year, while nominal accounts like depreciation expense are closed out at year end. Under the sum-of-the-years’ digits method, a company strives to record more depreciation earlier in the life of an asset and less in the later years.

Why is it essential that you track accumulated depreciation?

Multiply the valuable life of a fixed asset by the depreciable base to determine straight-line depreciation. Total accumulated depreciation expenses at the end of 31 December 2019 is USD440,000. While the depreciation expense is the amount recognized each period, the accumulated depreciation is the sum of all depreciation to date since purchase. If a company decides to purchase a fixed asset (PP&E), the total cash expenditure is incurred in once instance in the current period. After two years, the company realizes the remaining useful life is not three years but instead six years.

Double-Declining Balance (DDB) Depreciation Method Definition … – Investopedia

Double-Declining Balance (DDB) Depreciation Method Definition ….

Posted: Sat, 25 Mar 2017 22:10:12 GMT [source]

The double-declining balance method is a form of accelerated depreciation. It means that the asset will be depreciated faster than with the straight line method. The double-declining balance method results in higher depreciation expenses in the beginning of an asset’s life and lower depreciation expenses later.

You’ll note that the balance increases over time as depreciation expenses are added. Depreciation expense is considered a non-cash expense because the recurring monthly depreciation entry does not involve a cash transaction. Because of this, the statement of cash flows prepared under the indirect method adds the depreciation expense back to calculate cash flow from operations.

Other Methods of Depreciation

The decrease in the value of a fixed asset due to its usages over time is called depreciation. We credit the accumulated depreciation account because, as time passes, the company records the depreciation expense that is accumulated in the contra-asset account. However, there are situations when the accumulated depreciation account is debited or eliminated. For example, let’s say an asset has been used for 5 years and has an accumulated depreciation of $100,000 in total.

Two tremors near Dhaka raise concern – The Daily Star

Two tremors near Dhaka raise concern.

Posted: Sat, 06 May 2023 01:20:00 GMT [source]

The building is expected to be useful for 20 years with a value of $10,000 at the end of the 20th year. The depreciable base for the building is $240,000 ($250,000 – $10,000). Divided over 20 years, the company would recognized $20,000 of accumulated depreciation every year. Below is data for calculation of the accumulated depreciation on the balance sheet at the end of 1st year and 3rd year. Depreciation Expense ChargedDepreciation is a systematic allocation method used to account for the costs of any physical or tangible asset throughout its useful life.

Get instant access to video lessons taught by experienced investment bankers. Learn financial statement modeling, DCF, M&A, LBO, Comps and Excel shortcuts. Accumulated depreciation is the sum of all recorded depreciation on an asset to a specific date. This insights and his love for researching SaaS products enables him to provide in-depth, fact-based software reviews to enable software buyers make better decisions. Subtracting the depreciation amount for the second from $9,000 will leave you with $5,400, which will automatically be your book balance for the third year.

The naming convention is just different depending on the nature of the asset. For tangible assets such as property or plant and equipment, it is referred to as depreciation. After the 5-year period, if the company were to sell the asset, the account would need to be zeroed out because the asset is not relevant to the company anymore.

Depreciation is an accounting method that spreads out the cost of an asset over its useful life. Depreciation should be charged for the proper estimation of periodic profit or loss. To calculate accumulated depreciation, there are 3 important factors you need to consider. To give an accurate record of an asset’s historical cost and depreciation over time. A decreasing balance approach accelerates the reporting of depreciation expenditure for assets in their early stages of useful life.

Accumulated depreciation totals depreciation expense since the asset has been in use. Generation of adequate funds in the hands of the business for assets replacement at the end of its useful life. Depreciation is a good indication of the amount an enterprise should set aside to replace a fixed asset after its economic useful life is over.

How exactly does accumulated depreciation work?

Recording accumulated depreciation of assets can be carried in a single journal designed to accommodate all types of fixed assets. Or it may be subdivided into separate entries for each type of fixed asset. It is the total amount of a fixed asset’s cost that has been allocated to depreciation expense since the asset was put into service. Let’s go through an example using the four methods of depreciation described so far. Assume that our company has an asset with an initial cost of $50,000, a salvage value of $10,000, and a useful life of five years and 3,000 units, as shown in the screenshot below.

For example, say a company was depreciating a $10,000 asset over its five year useful life with no salvage value. Using the straight-line method, accumulated depreciation of $2,000 is recognized. There are two main differences between accumulated depreciation and depreciation expense. First, depreciation expense is reported on the income statement, while accumulated depreciation is reported on the balance sheet. Over time, the assets a company owns lose value, which is known as depreciation. As the value of these assets declines over time, the depreciated amount is recorded as an expense on the balance sheet.

An asset’s carrying value on the balance sheet is the difference between its historical cost and accumulated depreciation. At the end of an asset’s useful life, its carrying value on the balance sheet will match its salvage value. Accumulated depreciation is a contra asset account and unlike a normal asset account, a credit to a contra-asset account increases its value while a debit decreases its value. Therefore, the accumulated depreciation account will be credited in the books of accounts of the company.

Accountants use the straight line depreciation method because it is the easiest to compute and can be applied to all long-term assets. However, the straight line method does not accurately reflect the difference in usage of an asset and may not be the most appropriate value calculation method for some depreciable assets. Each period in which depreciation is recorded, the carrying value of the fixed asset, i.e. the property, plant and equipment (PP&E) line item on the balance sheet, is gradually reduced. Watch this short video to quickly understand the main concepts covered in this guide, including what accumulated depreciation is and how depreciation expenses are calculated. The double-declining balance depreciation method is an accelerated method that multiplies an asset’s value by a depreciation rate. This change is reflected as a change in accounting estimate, not a change in accounting principle.

So since the life of the toy-producing machine above is 15 years, we will add together the digits representing the number of years of the life of the assets. If you are interested in learning more about depreciation, be sure to visit our depreciation calculator. Additionally, if you are interested in learning what revenue is and how to calculate it, visit our revenue calculator. The cost of the PP&E – i.e. the $100 million capital expenditure – is not recognized all at once in the period incurred.

ways to calculate depreciation in Excel

In fact, it is a contra-asset account, situated within the non-current asset section of a balance sheet. In trial balance, the accumulated depreciation expenses are the contra account of the fixed assets accounts. When recording depreciation in the general ledger, a company debits depreciation expense and credits accumulated depreciation. Depreciation expense flows through to the income statement in the period it is recorded. Accumulated depreciation is presented on the balance sheet below the line for related capitalized assets.

Second, on a related note, the income statement does not carry from year-to-year. Activity is swept to retained earnings, and a company “resets” its income statement every year. Meanwhile, its balance sheet is a life-to-date running total that does not clear at year-end. Therefore, depreciation expense is recalculated every year, while accumulated depreciation is always a life-to-date running total. The total amount of accumulated depreciation for a fixed asset will increase over time as depreciation continues to be charged for an asset over the life of it. When the original cost or the gross cost is reduced of any amount of accumulated depreciation and any impairment is called the net cost or carrying the cost.

Depreciation expenses, on the other hand, are the allocated portion of the cost of a company’s fixed assets for a certain period. Depreciation expense is recognized on the income statement as a non-cash expense that reduces the company’s net income or profit. For accounting purposes, the depreciation expense is debited, and the accumulated depreciation is credited.

- Depreciation expense is considered a non-cash expense because the recurring monthly depreciation entry does not involve a cash transaction.

- In this article, you will learn everything you need to know about accumulated depreciation, how to calculate it, and the best accumulated depreciation calculators.

- Our operating margin calculator helps you to assess the operational efficiency of a company.

- Activity is swept to retained earnings, and a company “resets” its income statement every year.

Company ABC bought machinery worth $10,00,000, which is a fixed asset for the business. It has a useful life of 10 years and a salvage value of $1,00,000 at the end of its useful life. Depreciation for the company is calculated using the straight-line method, which is $90,000 per year for the next 10 years until the value of the machinery becomes $1,00,000. Each year the accumulated depreciation account will increase by $90,000 per year. Therefore, for example, at the end of 5 years, annual depreciation is $90,000 but the cumulative depreciation is 4,50,0000. Recording accumulated depreciation as a debit entry creates a wrong impression of the asset being a liability to a third party, which is not the case.

It is calculated by simply dividing the cost of an asset, less its salvage value, by the useful life of the asset. Accumulated depreciation is calculated by subtracting the estimated scrap/salvage value at the end of its useful life from the initial cost of an asset. And then divided by the number of the estimated useful life of an asset. In other ways, accumulated depreciation is calculated by the sum of all of the depreciation charges to assets from the beginning up to the latest reporting period. Businesses have fixed assets that continue to be useful for many years. We capitalize such assets to match the expense of the asset to the total period it proves economically beneficial to the company.

When an asset is first purchased, it’s typically assigned a value reflecting its expected lifespan, gradually reducing over time. You can use this information to calculate the financial status of an asset at any time. Accumulated depreciation is an accounting formula that you can use to calculate the losses on asset value. By understanding the best ways to report the depreciation of business assets, you’ll improve the transparency of your business finances and the utility and predictive power of the data. Your business can make better decisions when you understand the financial status of assets. Accumulated depreciation is used to calculate an asset’s net book value, which is the value of an asset carried on the balance sheet.

- The building is expected to be useful for 20 years with a value of $10,000 at the end of the 20th year.

- Many companies rely on capital assets such as buildings, vehicles, equipment, and machinery as part of their operations.

- The straight-line method is a simple method for calculating accumulated depreciation.

- Accumulated depreciation is not an asset; it does not offer any long-term value.

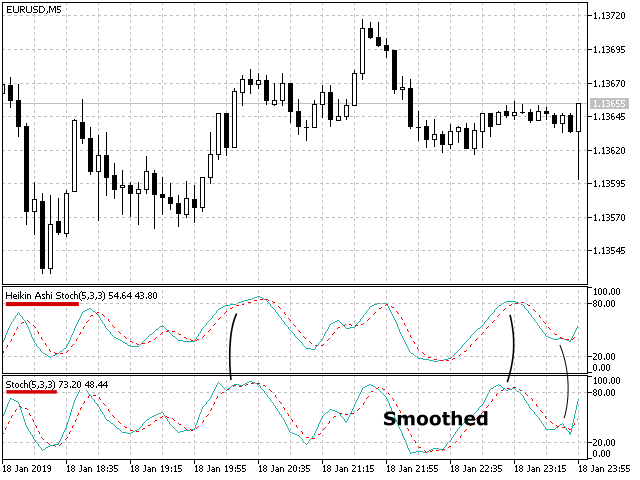

accumulated depreciation formulaStuff offers a variety of supporting information to make understanding depreciation calculation much easier. Their site also contains a graphical representation of the relationship between depreciation expense and the book value. Several online sites calculate depreciation accurately based on the data given to them. Some of the best accumulated depressions include CalculatorSoup, CalculateStuff, and Calculator Academy.

This method is used with assets that quickly lose value early in their useful life. A company may also choose to go with this method if it offers them tax or cash flow advantages. The accumulated depreciation account is a contra asset account on a company’s balance sheet. It appears as a reduction from the gross amount of fixed assets reported. Accumulated depreciation specifies the total amount of an asset’s wear to date in the asset’s useful life.